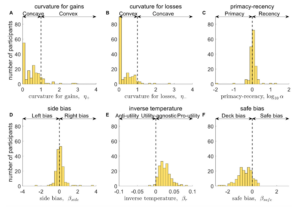

A new paper in Scientific Reports by ADDL postdoc Dr. Shensheng Wang, Dr. Bob Wilson (Georgia Tech), Dr. Natalie Ebner (UF), and Dr. Lighthall describes the cognitive biases that drive decision making using the novel Florida-And-Georgia (FLAG) gambling task. The team’s new FLAG task allows for modeling complex, experience-dependent decision making under uncertainty that involves positive and negative outliers, gains and losses, as well as sequential outcome sampling. The FLAG task applies computational modeling to simultaneously examine and isolate the effects of multiple cognitive biases in decision making, including sensitivity to outliers, loss aversion, and primacy-recency bias.

Findings from 170 young adults showed that when faced with multiple outcomes over repeated interactions, individuals tend to underweight outliers for both gains and losses. In addition, participants exhibited a recency bias, weighing outcomes of more recent example cards more heavily when making a decision. In contrast, however, participants did not exhibit loss aversion as predicted by Prospect Theory. These results suggest that loss aversion might not be as robust when combined with other decision features, as when it is examined in isolation. Instead, 63% of the study’s participants exhibited gain-seeking behavior — findings aligned with those of financial professionals (a notable proportion of whom tend to emphasize gains and downplay losses) and investment behavior that has contributed to historical financial crises.

For access to the paper: